It was a while that I was struggling to understand my shortcomings, vulnerabilities, and deficiencies. The principles that I claimed to believe were not translating into my day to day transactions. Those principles were not transforming my life. They were just claims with no practical impact. I was not at peace with myself. My situation was not acceptable to me. My interactions and engagements were not appropriate. The way I was handling certain situations bothered me later on. I was frustrated with myself. Basically, I was struggling to align my principles with practical life circumstances. I noted that the struggle between my principles and my behavior was an ongoing phenomenon. Initially, I thought that outside forces were to be blamed. I was pointing fingers at external circumstances, peer pressure, others behavior, etc. Eventually, I wanted to explore further and find out the root cause of this chaos within me. After many years of soul searching, finally, an opportunity to change my situation was revealed to me. I realized the solution to my struggle was to make those principles that I believed in, as part of my personality and ultimately identity. Those principles had to be internalized within my belief system in order to make peace with myself. The solution was within me and I was searching outside. What a waste of time? Fundamentally, it boils down to being sincere with ourselves. Whatever principle(s) we believe in, first and foremost we have to digest within ourselves and accept it fully with no doubt. If there is any doubt, then we are not convinced. We have to believe in what we propose. Otherwise, we will constantly be in an unstable state of mind which leads to our constant state of fragility. Once we internalize our principles, eventually, it will become our identity. As a result, it will solidify our self-esteem and self-confidence. Consequently, in our interactions with others, we will be truly who we are. We don’t see a need to “fake it till we make it.” Our true beliefs and principles will be on display. We don’t need to impress others. They will be impressed with our genuinity and sincerity. To understand the concept of internalizing our principles, as an example, I will elaborate on one principle that I firmly believe in. I will briefly explain how this principle could be internalized and more importantly how it will change us when it becomes part of our identity. LUCK ROLE: If you are reading these passages, you are lucky; not because you are reading this specific article but rather because you are “able” to read. How many people we know who can not read either because they have physical impairment or lack formal education? So we are all lucky. One of the principles that can help to change us is the principle of believing that we are lucky. If we look back at our life and reflect, we will soon realize that a wide range of so-called “incidents” have played a role in our life. Perhaps we could say that our destiny was shaped by these incidents. We could have been in a completely different situation. For a moment, just imagine if we were born in a different family or a different country, how our lives could have been different. Our whole life is full of these so-called incidents ranging from the people we met to places we found ourselves. How each of these “incidents” changed the course of our life for good? Have you ever thought that our life could have taken a different path with slightly contrasting variables? For example, instead of going to school A, and meeting our best friend, we went to school B, and met a completely different personality. Imagine the same at our workplace, friend or family circles, etc. As we noted, life is full of “incidents” and we are lucky to be who we are at this particular moment in time. Things could have been a lot different and perhaps a lot worse. We have to find a way to completely grasp this concept and internalize within our belief system. I understand this can not happen overnight but if we make a commitment to find a way to make this principle part of our identity, it will turn into an internal struggle. Once it becomes a struggle, then we will notice and remember this concept in every transaction in life and appreciate our situation much better. And hopefully one day, it will become part of our identity. This process of believing that we are lucky will start to influence us to be more humble. Once “luck” becomes part of our identity, we will interact with others differently. We will feel lucky and understand others much better. We will empathize with them and appreciate their situation. This will definitely bring a change within us and more importantly change our behavior toward others. This one principle alone could change our life forever and impact every aspect of our life ranging from being “content” with our current situation to being respectful to others. We could take this principle, as a sample, and extend it to all other principles that we firmly believe in and start the process of internalizing them so that they become part of our identity. HOW TO INTERNALIZE IDENTITY? I am certain we all have certain principles that we believe in. We have to find a way to convert those principles into internal struggle within ourselves. For example, if we believe in “dignity of life” then we have to find ways to internalize this concept within ourselves. Further, we have to analyze ourselves in every interaction to assess if our beliefs match our behavior and thought process. Of course, this is a never ending struggle. But I can assure you that if we find a way to internalize this concept, it will slowly but surely, change our behavior and more importantly we will be at peace with ourselves. Finally, this ongoing struggle is a humbling process and reveals our own weaknesses and vulnerabilities to ourselves. Therefore, to summarize, there are three steps to internalizing your principles and making them part of your identity. The three steps are as follows:

We are not expecting to internalize these principles overnight. We need time and patience. We will continue to struggle. But we have to practice the process of internalization. Further, we have to keep on monitoring every step of the way, and then assessing and reflecting within ourselves to align better in future transactions. At last, hopefully, our inner identity shapes our personality and as a result we will bring change to our sphere of influence one principle at a time. For anyone who wants to change their world, start with internal change….

0 Comments

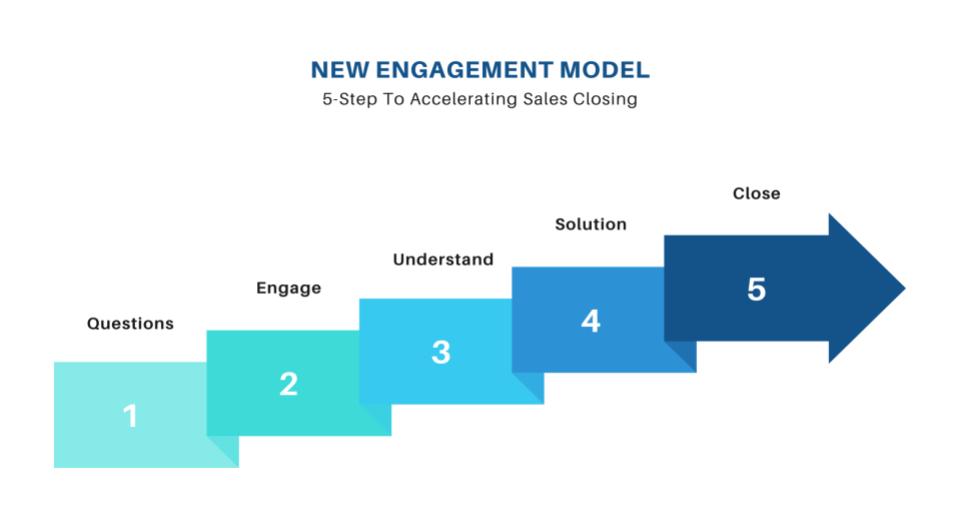

The vibrancy and longevity of our business depends on our sales performance. Whether we are a small business operator or a corporate conglomerate, sales is our lifeline. Even if we are a not-for-profit institution, we need sales (revenue) to run our organization. Basically, sales is crucial to the existence of every business. Therefore, it deserves our full attention, dedication and commitment. Organizations are working tirelessly to accelerate their sales performance. It is a consistent challenge, as factors that play a role in a successful sales closing, constantly changes. Businesses have to shift and adapt on a continuous basis. As a result, they are willing to try all options available on the “table” to accelerate their sales closing. We have come a long way in our sales history; from the days of “Always Be Closing” (ABC) to our most recent claims of “content is King”, within the sales context. We have tried and tested them all and sometimes we felt genius when it worked while other times it disappointed us. It is a shifting target and we have to constantly chase and adapt accordingly. ENGAGEMENT: One thing that has remained constant, throughout sales history, is the importance of “Engagement” in establishing our Prospect’s/Client’s trust. We already know that we can not successfully complete a transaction if we do not gain the trust of our Prospect. Basically, the more we “Engage” with our “Prospect”, the better results we get. What do we mean by “Engage”? In simple terms, it means that both the “Advisor/Salesperson” and the “Prospect/Client” are on the same side. They work together to find a solution to the problem. They “collaborate” to achieve the goal and not play a “cat and mouse game”. The only thing that has changed, from the past, is the medium of “Engagement”. In the past, people might have “Engaged” in person, but nowadays, thanks to advancements in technology and changes in people’s behaviour and expectations, it is possible to do the same online. We call it “Online Workspace”. At the moment, our “Prospects” are “Engaging” with our so-called online content. However, recent research clearly indicates that people are overwhelmed with so much content available at their disposal. Most of the time, they are lost and confused moving from one content to the other, as one of the researches state that: “Research shows that if you’re surrounded by an abundance of options, you typically end up less satisfied with your final decision than if you’d been given fewer options in the first place.” Further, there are many of our “Prospects” that have no patience for consuming any more content. “Prospects” prefer to get to the answer right away, with no delays and no effort. Giving them more content is the wrong solution. They want answers to their inquiry now. And if we don’t give them what they are looking for, they will move on. Successful organizations give immediate answers to specific questions in the context of their “Prospect’s” problem. “Prospects” have no patience to be “Educated” anymore. They are looking for a specific answer to their specific problem. HANDLING INQUIRIES: So, we have to shift our focus from generating more content to more “answering”. We have to move from “wasting” our Prospect’s time to saving them time by handling their inquiries. Of course, handling their inquiries is not simple. We need to allocate resources to handle their inquiries ranging from “platforms” that facilitate “Engagement” to AI technologies that work at our Prospect’s term and timing. Remember that “Prospects” are not looking for a “generic” answer. They are looking for a “specific” answer to their “specific” inquiry. Hence, this requires “expertise”, someone who truly knows ins and outs of the business. Just a side note here, investing resources to educate your people that are handling these inquiries are worth every penny of it. You can not outsource this service. It has to be internalized in your entire organization. Additionally, this “qualified expert” has to believe in the answers that are provided to the inquiries. With belief comes conviction. Your belief in your solution makes your “Prospect” believe in you and your answers. Always remember that people have a sixth sense and with the help of their intuition they know whether your answers are authentic or not. Please don’t try to trick them into something that you don’t believe in. Our experience further gives us evidence that our “Prospect” wants to be involved in the buying process. What a better way than to “Engage” them. This opportunity is never given to them until now. We know better now that our “Prospects” prefer to be involved in every step of the way. CHANGE FROM CONTENT TO QUESTION: Let me make it simple for you. You have to break down your “content” into Questions. I am assuming here that you have done your homework and understand your “Prospect” problems and have prepared content accordingly. With that understanding, now is the time to utilize that content and prepare intelligent and informative questions to peak your “Prospect’s” interest. Having said that, I want to be very clear that there is no “one size fits all” strategy here. Breaking down the content to Questions is just the beginning and background material to prepare your mindset. It needs much more effort than that as each “Prospect” has a different problem and each problem has different types of inquiries. So each inquiry deserves its own unique answer. That is why, I emphasised earlier, that the person who is handling “Prospect” inquiries has to be a qualified “expert” who knows what they are talking about. HOW IT WORKS? After the above introduction, now I feel comfortable to give you my secret recipe for accelerating your sales closing. The secret is already disclosed, which is: the time of “content”, in the sales context, is gone and now we are living in the era of “Engagement”. The formula is very simple. First and foremost, you have to clearly understand your “Prospect’s” problem and secondly provide a specific and precise solution to that problem. This is what we call a “Perfect Fit”. Of course, in order to understand their problem, you need to “Engage”. The most effective way to “Engage” is to come up with “Questions” that give you valuable information. Using that information, you will come up with a perfect prescription that fixes your “Client’s” problem. The following three crucial ingredients are required for a successful “Engagement”. Keep in mind that you need all three to accelerate your sales closing. If any one of them is missing, it won’t happen. So here you go:

1. ONE TO ONE EXPERIENCE: You need an exclusive “platform” where your prospects feel comfortable to “Engage” with you. You can utilize any online platform that allows you to seclude your “Prospect” and offer a one to one experience. There should be no distraction whatsoever. Social Media platforms don't serve the purpose as there are many ongoing distractions. Your “Prospect'' should feel that you are fully dedicated with full attention for this particular “Engagement”. You are not distracted with anything else. If we expect their attendance, they also expect our undivided attention. Imagine as if you both are in a private room and having a one to one meeting. It is simply bringing that offline experience online. In simple words, it is an “Online Workspace” for you and your “Prospect”. I couldn’t find any online solution, to my knowledge, that caters to this specific need. Therefore, we had to custom build our own online platform to do the job. We don’t mind our colleagues in the industry subscribing to it. The objective of our platform is that once you find your “ideal fit”, you can not afford to lose them. You have to sort through many “Leads” to get to that “ideal one”. You want to “Engage” with that “one” until it closes. You cannot achieve the same with traditional tools such as email, phone calls, texts, etc. All existing tools are sporadic with no consistency. Basically, the “Leads” that are a “good fit” are so valuable and so much have been invested in them, that you can not afford to lose them. You want to “Hug” them and not let them go. 2. CURIOUS CONTENT: You need a very “small” piece of content that raises a question in your “Prospects” mind. This piece of content could be as simple as a sentence or a sophisticated graphically designed poster, as long as it intrigues your “Prospect” to come to your “secluded” online workspace. This content might be “small” but definitely it is not easy to prepare. You need creativity to understand how to trigger your “Prospect’s” sense of curiosity. This will take a lot of effort from all stakeholders involved in acquiring the “Client”. Therefore, it takes teamwork to make this sophisticated piece of “Art” come to creation. It is like an “ice breaker” for a conversation. Ideally, “Curious Content” is in the form of a “Question” which makes your “Prospect”, unconsciously, say: “But that is exactly my question…” 3. RELEVANT QUESTIONS: Once you have your prospect onboard, with the help of “Curious Content”, now is the time to sharpen your skills and put them at work. You have to raise questions that will intrigue your prospect to answer. Each of those questions asked are valuable and can not be wasted by asking unnecessary or irrelevant questions. It will turn off your “Prospect” and he/she will abandon you. Now, in order to ask proper and relevant questions, please keep following in mind:

With the above “sales ingredient”, you will definitely perform better than ever. How do I know? I know because this is what today’s “Prospect” is looking for; a specific answer to a specific question. As a result, this will accelerate your sales closings. Did you notice, I did not say: “sales process”, I said “sales closing” intentionally because at the end of the day what matters is results. You already know how to handle your sales process. You need to close. You can only close if you listen to your “Interested Clients”. They want answers now… And you need Questions to get those answers. Property owners know that without tenants they are spending money everyday that should otherwise be paid by their tenants. Filling those vacancies is a huge expense as well. Signs, ads, flyers… this list goes on about how to showcase and market your property and entice tenants to fill your space. You may decide to reduce the rent or add other incentives to increase some interest in your property…. which all adds to the expense of having vacancies in your building. And in 5 years time you may have to start the whole process over again. It’s time you considered converting your building into condos and remove the frustration of the never-ending tenant search. By converting your building into condominiums you are creating property owners out of business owners and at the same time you are able to cash out the equity you have built up in your property. These new condo property owners pay their share of the taxes, maintenance, insurance and utilities so you have less to worry about. And because they own their property, these businesses are much less likely to move out at the end of the rental term – because there isn’t one! We have a variety of strategies to discuss with you that can help you fill your vacancies, turn the built-up equity of your property into cash and eliminate the stress of dealing with tenants. Build it, Renovate it, Fill it.These are the standard ways to add value to your commercial property or to pull equity out of your property. Condo conversion is the most profitable way to add value to a commercial property. This allows you to cash out the equity without having to necessarily add extra value through renovations or additional building steps. The condo conversion process is not for the faint of heart. The steps are complicated and time-consuming. But the rewards are great. Depending on the final goal of the conversion process you can withdraw the built-up equity of the property while you offload many of the expenses and headaches of property ownership to the new condo owners, all the while maintaining a stake in your property. There are many ways to add value to a property. Below is a list you can start with: Add Income: The most common and simple way to add value is to increase income by filling vacancies or creating additional space to be rented. Increasing the gross income, obviously, increases your net income, which indeed increases the value of the property. This could also be achieved by renovating the building and charging higher rents upon lease renewal. Conversely, the best way to increase the bottom line might be to find ways to decrease expenses by operating the property more efficiently. The best example could be employing energy efficiency measures. Change Of Use: Another popular way to increase the value is to change the use to the best and highest use possible; for example, changing a building from residential to commercial use. Land Assembly: In some prime areas, multiple adjacent properties are acquired to build a multiple-unit property. For example, buying three adjacent detached homes to build ten townhouses. Thorough due diligence measures are required to make sure that the zoning allows for this type of development on the specified lots. Divide And Conquer: Buying a big lot and dividing it into smaller lots is an established way of increasing the value of a property. Basically, buying in bulk and selling at retail price. Condo Conversion: This is the process of converting a property from one title to multiple titles to be sold separately. The process is similar to subdividing a big lot, but the process is a lot more complex. Examples could include converting an apartment building to condo residential, or office building to office condos and so on. A property that has the potential for value growth through the change-of-use process of condo conversion is what we specialize in. Watch a video, Jamshid Hussaini Discussing “Change Of Use” And How To Add Value To A Property. A professional evaluation of your building will help you decide if the conversion to condominiums will help you to turn the equity you have in your property into profit.

James Hussaini leads the way with his experience in evaluating properties and he has an outstanding track record for the successful completion of many Toronto area buildings into condos. What needs to be considered before the evaluation

Property ownership is a vehicle for creating income and wealth the standard way:

And it’s long term. But what happens when you need to tap the equity of a property that has vacancies? Or has a large mortgage on it with little equity or income? The solution is to convert the building into condos. This allows you to realize the equity you’ve built up and at the same time shift much of the expenses onto new owners that can afford a smaller piece of a property but not the whole building. Evaluate Your Commercial Property Before Considering Condo Conversion Generally speaking, two factors play a crucial role in evaluating a commercial property: income and capital gain. Two Types of Economic Value: From a very broad perspective, commercial properties can be evaluated by taking into consideration two factors: net income and capital gain. Here is a brief outline. Net Income Net income refers to the overall income the property generates, considering both current net income and potential net income. Although there are discussions around the meaning of “net income”, “net net income” and “net net net income”, what it boils down to is that net income is the income a property generates after paying all its expenses such as property taxes, utilities, maintenance, etc. The net income is generally accounted for before paying debt (mortgage) and taxes (income tax). Capital Gain In addition to hard numbers (net income), the existing and future income potential of the property is considered. In the near term, income potential can be predicted through change of use approvals by the local municipality. But it is quite challenging to predict the future potential of the property as it could depend on multiple factors such as economic growth and job creation, future development plans, etc. Again, assessing capital gain is a lot more complicated than it sounds, but suffice it to say that any potential the property may have in the future is to be considered at the time of evaluating the property. Realizing the Highest Value Once your evaluation is completed you can determine under which “change of use” the property can meet it’s highest profit potential. This complicated procedure should only be undertaken by a qualified specialist to ensure that anything that will impact the overall value has been taken into consideration. This can include (but not limited to):

We can help you add value to your property using the condo conversion change-of-use that we specialize in. We have the experience, and the professional team to back us up, that you need. The condo conversion case study below is an example only and the financial structure is simplified in order to demonstrate how to move a property from its current status to a higher-value use. Everything in a project can go more or less as planned, but the final exit is what makes or breaks it.

Here is a snapshot of the team involvement needed to highlight the complexity involved:

Case Study: Converting an almost-vacant building Background: The owner was busy operating a manufacturing business and didn’t have the time, resources or expertise to manage the building. As a result the office building was not tenanted and the owner desperately wanted to let go of a property that he considered a distraction and a headache. When I came into the picture, I evaluated the property and found that it did not meet my basic criteria. The current income could cover the expenses but not the mortgage I needed to take out on the building. Financing: Leading the investor group, I worked with the owner to overcome the mortgage issue. As the property had no mortgage, we struck a deal where the owner would provide an interest-free VTB (vendor take-back) for 75 percent of the purchase price until the end of the condo conversion process.

Adding value to the property: This building, located in a suburban downtown area, had about 20% occupied space so filling the vacant space became the primary focus of adding value to the project. Completing the condo conversion and filling it with new owners is the main focus to improving its value and allowing my group of investors to realize profit on their investment. Marketing the condo units: Once the conversion was complete, and because of the type of financing arranged, we were able to offer potential condo owners a “Free Rent” option that allowed them to purchase their condo space with no down payment and use the accrued rent over 5 years as their down payment towards purchase once they have arranged their mortgage for the balance of the purchase price. This created a “win-win” situation for my investors and the tenant owners. Exiting profitably: As the building fills up with new tenants that have an agreement in place to purchase their condo units, the investor group can realize substantial profit. It needs to be noted that individuals involved need to be entrepreneurial-minded and understand the concept of risk and reward. They must be prepared, both financially and emotionally, for ups and downs in the business. The return estimated on this project is as follows:

As a property owner, we can help you realize the full potential of your property through our experience with the condo conversion process, from start to finish. Commercial Real Estate requires a different skill set.

For many different reasons, you might prefer to serve commercial clients. Whatever your reasons might be, you ought to understand that you have to be very competent to work in the world of commercial real estate. You can become knowledgeable by taking professional development courses in commercial real estate and shadowing an experienced commercial real estate professional. As a commercial real estate sales professional, you have to be sufficiently knowledgeable about different types of commercial properties to offer the client the most viable option depending on their circumstances and needs.When advising clients on property acquisition, the old real estate mantra of “location, location, location” might come to mind. Of course, location is important in any piece of real estate. However, in the world of commercial real estate, another mantra is used: “Jobs, Jobs, Jobs.” The current and future state of employment in the area where the commercial property is located has a significant impact on its current value and will have on its future value. You have to be well-versed on the type of property you are going to suggest that the buyer acquire. Further, you have to consider the assets and resources of your client when making a specific suggestion. Due Diligence Although it is a norm in the world of commercial real estate that the listing sales professional provide all the information and details related to the property, ranging from income potential to structural details, you as the buyer’s representative must perform necessary due to diligence on behalf of your buyer. Information and details have to be verified, from net income “claimed” to uses “allowed.” Therefore, proper due diligence is required. Here are the most important aspects of due diligence that need to be carried out: Due Diligence Aspect #1: Income You have to understand that, generally speaking, your buyers are mainly interested in commercial properties to generate income.While the buyer is likely to have a mix of investment vehicles, such as a stock portfolio, Registered Retirement Savings Plan (RRSP), Guaranteed Investment Certificates (GICs), mutual funds, etc., the buyer is considering an investment in a commercial property. The buyer may wish to park their money in a tangible asset or commercial properties as these investments might offer superior tax-saving strategies. Many investors believe that a positive cash flow will keep them above water when markets experience volatility and reduce overall exposure. So your first and foremost concern should be about the income generation of the property. You have to do your full due diligence on the income aspect of the property. The numbers disclosed might not necessarily take into account all of the deficiencies and costs related to the property. Generally, the following are the numbers to watch as they have potential for error and miscalculation:

By far one of the most overlooked items when calculating income is “tenant credibility.” The net income numbers might suggest purchasing the property is justified, but you have to remember that some tenants may have established a profitable business, but others may be in financial difficulty. Corporate searches and due diligence might reveal that the tenant is in financial difficulty. Your first and foremost concern should be about the income generation of the property. Corporate searches and due diligence on tenants, especially the ones that occupy bigger spaces in the building, are a must. Further, you may ask for financial statements from the existing tenants. In fact, your financial lender might require those statements from the tenants of the building anyway. Due Diligence Aspect #2: Capital Expenditures A property’s income might seem very attractive, but you may not be aware of the capital expenditures required to operate the building. These expenditures could be big-ticket items such as replacing windows, roof repairs, HVAC upgrades, mechanical systems, etc. There could even be structural issues with the property which could sometimes cost more than the purchase price. You should solicit inspection reports from HVAC and engineering specialists. Due Diligence Aspect #3: Specific Requirements When acquiring commercial properties your client may have specific plans for the property. These plans could be implemented right after the property acquisition or in the future. Below are a few examples of issues and pitfalls that you may want to investigate further. When the Property Is Owner-Occupied In addition to the above due diligence items, if your client intends to operate a business in the property, you have to find out if the legal use of the property will allow your client to do so. If not, then ascertaining what permits and additional items are required is for you to find out. In addition to zoning, some uses might require a business license. For example, a day care center might require a playground to get its license, and a restaurant might need additional parking spots to get approval. Do not assume you do not have to carry out due diligence if a similar business is in the property. For example, a restaurant that operates as a fast-food takeout restaurant compared to a sit-in restaurant might have different zoning and parking requirements. So due diligence is required to be assured of the correct future use regardless of the existing use of the property. In our previous post, we discussed the steps needed before an evaluation. Today, we will discuss the evaluation process in a little more detail.

There is a significant difference between evaluating a residential house and assessing a commercial building. When listing a residential property, emotional factors are taken into consideration, whereas when assessing a commercial property more weight is given to hard numbers. Generally speaking, two factors play a crucial role in evaluating a commercial property: income and capital gain. Two types of Economic Value From a very broad perspective, commercial properties can be evaluated by taking into consideration two factors: net income and capital gain. Capital Gain: In addition to hard numbers (net income), the existing and future income potential of the property is considered. In the near term, income potential can be predicted through the change of use approvals by the local municipality. But it is quite challenging to predict the future potential of the property as it could depend on multiple factors such as economic growth and job creation, future development plans, etc. Again, assessing capital gain is a lot more complicated than it sounds, but suffice it to say that any potential property may have in the future is to be considered at the time of evaluating the property. Net Income: Net income refers to the overall income the property generates, considering both current net income and potential net income. Although there are discussions around the meaning of “net income”, “net net income” and “net net net income”, what it boils down to is that net income is the income a property generates after paying all its expenses such as property taxes, utilities, maintenance, etc. The net income is generally accounted for before paying debt (mortgage) and taxes (income tax). Know the Cap Rate There is another term you have to be familiar with in order to calculate the value of the property: Cap Rate. It is used in relation to net income to evaluate the property. Cap rates are determined by the current conditions of the market for the area in which the property is located, and the type of property it is. Although cap rates on a particular type of property may differ from area to area, usually cap rates are lower on apartment buildings and higher on office buildings. Remember that the higher the cap rate, the lower the price and vice versa. Cap rates can be as low as 3% and as high as 14%. This simply means that if you were to pay all cash for the property, you will get 3% or 14% on your money. For example, if you purchased property for $1 million and paid all cash, you would expect a return of $30,000 to $140,000 depending on multiple factors. These factors include property type, risks associated with the property, and the location of the property. Here is the formula for calculating the value of a commercial property: Value (Listing Price) = NOI (Net Operating Income) /Cap Rate Apartment Building Net Operating Income: $100,000 Apartment Building Cap Rate in The Area: 5% Value (Listing Price): $100,000 / 0.05 = $2,000,000 The same income with a 10% cap rate for an office building will give you a $1,000,000 listing price ($100,000 / 0.10). As you can see cap rates are a very important factor in your evaluations. You can search current commercial listings and recently closed transactions to gauge the cap rates in your market. Further, you can find valuable information in research-based reports published by commercial real estate firms in the area. Cap Rates and the location of the Property Cap rates are specific to the location of the property and the property type. The risk is also a factor; for example, apartment buildings are considered to be lower-risk investments and office buildings are a higher risk. The location of property can be assessed as follows:

Property type Different types of commercial properties and the risks associated with each type will influence your property evaluation. You have to understand different types of properties and their current demand in the market. Following are some of the most common types of commercial properties: Mixed use: Usually this is a retail environment on the main level and offices or apartments on the upper level(s). These type of properties are harder to rent as there are much better options available for the tenants. There are exceptions to this general rule, especially new mixed developments. Multi-Family: These are rental apartments ranging from a couple of storeys to high rises. In most markets, this is a lower-risk investment compared to other types of commercial properties.

Property Details to Consider for Finalizing the Listing Price In addition to the important factors of location and type of property, the features of the property must be considered before setting a final listing price. Here is a breakdown of each type of property and feature that impact the value. For a Residential Investment Property consider:

For a Retail/Strip Plaza consider:

Office Building Price Will Be Affected By:

For Industrial Properties consider:

|

AuthorBelieving education is power and has the ability to generate wealth – Jamshid has made a commitment to sharing his knowledge and expertise in the real estate. Categories

All

|

|

|

How we each choose to participate in our social responsibilities, as well as our business dealings, is what will create the world we want to leave for our children...

|

Copyright (c) 2009 - 2022 Hussaini.ca

RSS Feed

RSS Feed